Certificates for recyclates

PROTECTING SUPPLY CHAINS – MAKING WISER USE OF RECYCLED MATERIALS

The use of recycled plastics reduces dependence on fossil raw material imports and CO2 emissions. In order to increase the demand for recycled materials, the EU Commission has proposed binding recyclate use quotas of between 10 and 35 % for the plastic content in packaging from 2030 on – an important political signal on increasing investment in the circular economy. Nevertheless, by 2030, there will not be enough recyclates of the required quality to meet demand in the packaging market. Greater flexibility in the use of recyclates is urgently needed to protect supply chains and to enable the most economically efficient use of recyclates.

Certificates for recyclates

PROTECTING SUPPLY CHAINS – MAKING WISER USE OF RECYCLED MATERIALS

The use of recycled plastics reduces dependence on fossil raw material imports and CO2 emissions. In order to increase the demand for recycled materials, the EU Commission has proposed binding recyclate use quotas of between 10 and 35 % for the plastic content in packaging from 2030 on – an important political signal on increasing investment in the circular economy. Nevertheless, by 2030, there will not be enough recyclates of the required quality to meet demand in the packaging market. Greater flexibility in the use of recyclates is urgently needed to protect supply chains and to enable the most economically efficient use of recyclates.

Click the ⚙ icon to select a subtitle in one of five languages.

Shortage of recycled material looms from 2030 on

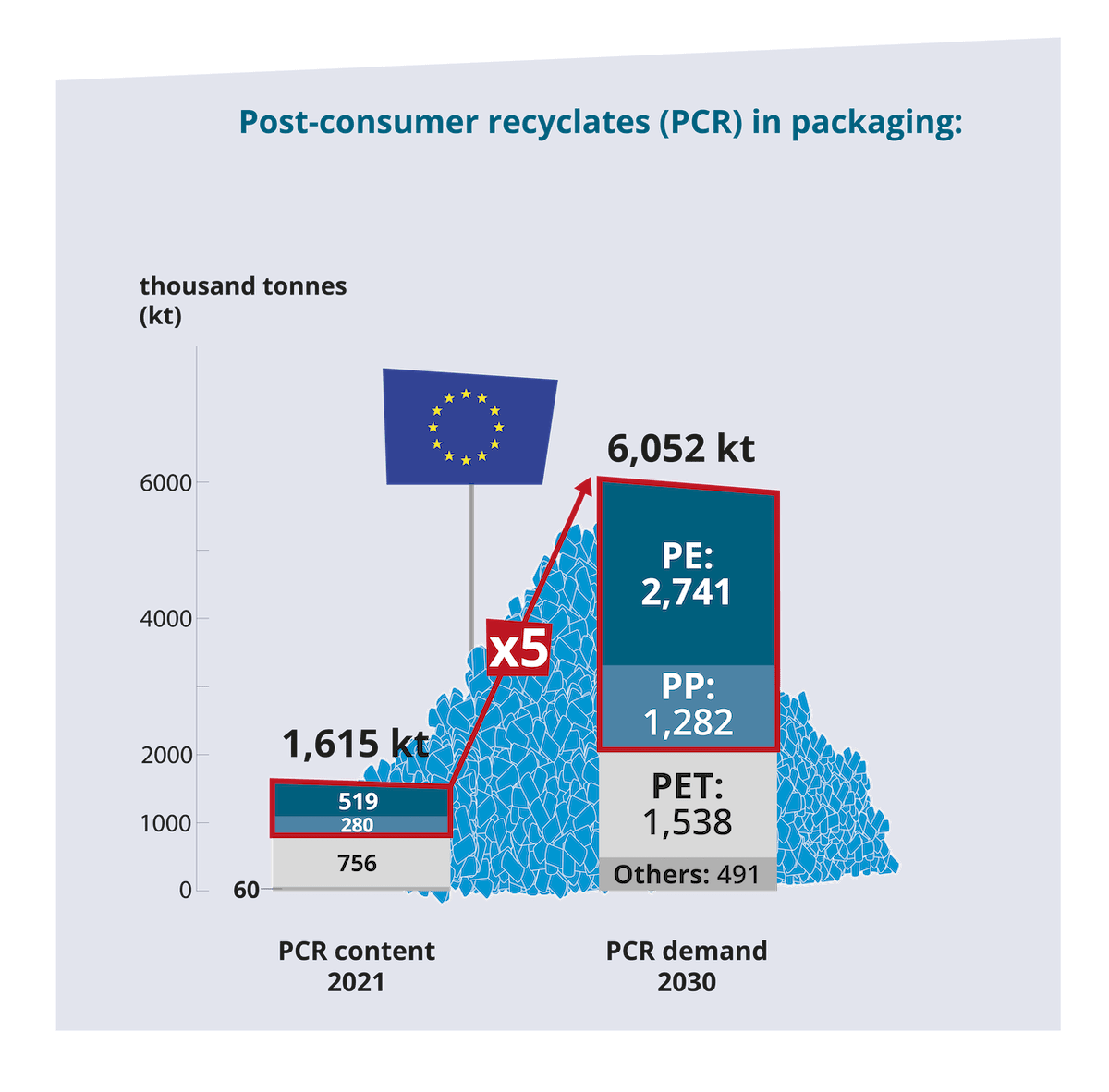

In order to achieve the quotas proposed by the Commission, the reuse of PCR in PP and PE packaging in Europe to would have to increase more than fivefold (!). In view of the development to date, this is highly unrealistic.

The main obstacles:

- the lack of separately collected waste and recycling rates in Europe that are too low (19 EU countries fail to meet plastic recycling targets),

- high quality requirements in the packaging market, such as in particular the lack of approvals for the use of PCR in food and other contact-sensitive packaging.

The risk of an inadequate supply of PCR is exacerbated by the fact that other industries will also be subject to legal obligations to use recyclates.

Shortage of recycled material threatens supply chains & SMEs

Packaging that cannot meet the legal requirements due to insufficient quantities and qualities will thus be banned from the market. This would have a severe impact on small and medium-sized manufacturers who will not be able to obtain recyclates in the required qualities on the open market, or only at much higher prices.

Amount of recycled polyolefins (PE, PP) would have to increase FIVEFOLD to meet the proposed 2030 recycled content quotas:

Source: Conversio Market & Strategy GmbH, 2023 (link). PCR demand in 2030 is based on an IC estimate for Germany. Simplifying assumptions: 50% of the processing volumes are contact-sensitive packaging and no company uses more than is legally required by quotas.

Let us introduce a credit system!

The idea is simple. Manufacturers who can use more recycled materials in their products receive credits that they can sell to other manufacturers who cannot yet meet the quota. In this way, we achieve the quota in the overall market, save fossil raw materials and secure supply chains in Europe.

Therefore, please include this concrete amendment proposal in the regulation:

“By 31 December 2026, the Commission is empowered to shall adopt implementing acts establishing the methodology for the calculation and verification of the percentage of recycled content recovered from post-consumer plastic waste, per unit of plastic packaging including a mass balance and credit-based approach, and the format for the technical documentation referred to in Annex VII. Those implementing acts shall be adopted in accordance with the examination procedure referred to in Article 59(3). The requirements set in paragraphs 1 and 2 may also be fulfilled by the use of recyclates of the equivalent amount and polymer type in other products.”

The proposed amendment is supported by:

Questions and answers

The Commission proposes mandatory recycled content quotas of between 10% and 35% for plastics in packaging from 2030. This corresponds to a EU-wide demand of approx. 6 million tonnes of post-consumer recyclates (PCR). Currently, about 1.6 million tonnes of PCR are used in packaging, mainly PET. To achieve the 2030 quotas proposed by the Commission, the reuse of PCR in packaging made of PP and PE in particular (which are the most important packaging polymers with approx. 70% market share) would have to be increased at least fivefold – an extreme challenge that is unrealistic in view of the developments to date.

Major hurdles are:

- There is still too little plastic waste separately collected and recycled across Europe – 19 EU countries are at risk of missing the 2025 plastic packaging recycling targets.

- The high quality requirements in the packaging market are for the time being still difficult to meet, in particular due to the lack of authorisations for the use of PCR in food and other contact-sensitive packaging. It remains unclear whether PCR from chemical recycling will be available in sufficient quantities from 2030 onwards, because the legal requirements for chemical recycling have not yet been established and because the investments in the capacities required have not yet been realised.

- Other sectors will also be given legal obligations to use recyclates. Already today, the vast majority of PCR from packaging is reused in other sectors such as construction, agriculture and automotive.

From 2030 onwards, large parts of the packaging market are therefore threatened by a shortage of recyclates.

It can be assumed that from 2030 onwards there will not be enough recyclates available in the required qualities to meet demand in the packaging market. This gives rise to various risks:

- Risks to supply chain security: Lack of PCR quantities and qualities for the packaging market pose a significant risk to supply chains and the secure supply of consumers in Europe, because packaging that does not meet the legal requirements would be banned from 2030.

- Risks for SMEs: Small and medium-sized manufacturers would be particularly affected by a shortage of supply, as they would not be able to obtain recyclates in the required qualities on the open market, or only at significantly worse terms.

- Ecological risks: A diversion of recycled plastics from other sectors to meet PCR quotas in the packaging market entails the risk that, due to the higher quality requirements, a far greater amount of energy has to be used for recycling (e.g. for chemical recycling), while more new plastic instead of recyclates are being used in those other sectors. Furthermore, there are risks of evasive movements towards laminated paper packaging, especially if these are exempted from mandatory PCR quotas and do not have to be highly recyclable.

The principle is simple: Manufacturer A who uses more PCR than required by the quotas receives credits for the surplus. Manufacturer A can sell these credits to manufacturer B, which cannot (yet) meet the quotas. Together, they achieve the quotas for PCR set in the PPWR.

Both sides benefit: Manufacturer A receives a financial incentive through the proceeds from credits to use more recyclates than would be required according to the quotas. Manufacturer B can meet the PCR quota through the purchase of credits and remain on the market with its products, even if there are not yet enough recyclates in the required qualities (e.g. for food contact) available.

How the system works in detail, including the verification and verification obligations of the participating companies, should be elaborated by the EU Commission in an implementing act based on Article 7(7) PPWR. We recommend as a condition that both sides, lender and borrower, must use plastics of the same polymer type (e.g. PE, PP, PET) in their products and produce highly recyclable products.

The credit system acts as a catalyst for transformation by increasing economic efficiency and mitigating economic and environmental risks.

- The credit system protects supply chains, SMEs and consumers: The risk of bans for certain packaging due to a lack of suitable recyclates is significantly reduced by the credit system, as producers can compensate for lacking recyclates by purchasing credits. This protects supply chains, especially of small and medium-sized enterprises, and the secure supply of consumers in Europe.

- The credit system reduces energy demand and transformation costs: The credit system ensures that PCR is preferentially used where it is most economically and energetically efficient and consumer prices are not unnecessarily increased. Food packaging does not necessarily have to become food packaging again if the use of recyclates is possible in other segments with lower energy and cost requirements as well as lower CO2

- The credit system promotes recyclability: Credits can be expected especially for those polymer types that are recycled on a large scale and are in demand. Packaging producers using these types of polymers are likely to benefit from a larger and cheaper supply of credits than users of polymer types whose recycling is less economical. This increases the economic efficiency of the transformation without having to ban rarer polymer types, which have their justification in certain functions. In addition, we recommend that the products that use the recyclates and receive credits should also be subject to requirements of high recyclability.

- The credit system ensures a level playing field between mechanical and chemical recycling processes. Although the EU’s discussions on mass balance calculations for chemical recycling are not yet finalised, it is likely that some form of allocation of PCR credits will be allowed to enable a higher recyclate share in some plastic products on the market (and a correspondingly lower recyclate share in other products to compensate). The credit system transfers this possibility of allocating PCR shares between different products to mechanically produced recyclates. It corresponds roughly to the “proportional” mass balance method, in which an allocation of credits within a polymer type is made possible.

- The credit system secures the demand for high-quality plastic recyclates and makes exemptions unnecessary: All packaging producers can contribute to increasing the use of recyclates through the credit system by putting highly recyclable packaging on the market and guaranteeing the reuse of recyclates from packaging recycling. Even if no or only little PCR can (yet) be used in certain packaging, no exceptions are necessary. This is a significant step forward in extended producer responsibility.

Which sectors may participate in the credit system can be determined by the EU Commission in the implementing act according to Article 7(7) PPWR. Only manufacturers of high-quality recyclable plastic products – such as packaging, construction products or automotive parts – should be entitled to receive and sell credits. It is crucial that more recyclates are used voluntarily than required by law and that the use of recyclates replaces fossil-derived plastics. Applications in which the recyclate does not replace virgin plastic should be excluded by law. Mere “squeezing” of PCR into products with low market value just to gain credits from them can thus be ruled out. In addition, the products themselves should meet design-for-recycling requirements so that they in turn are recyclable.

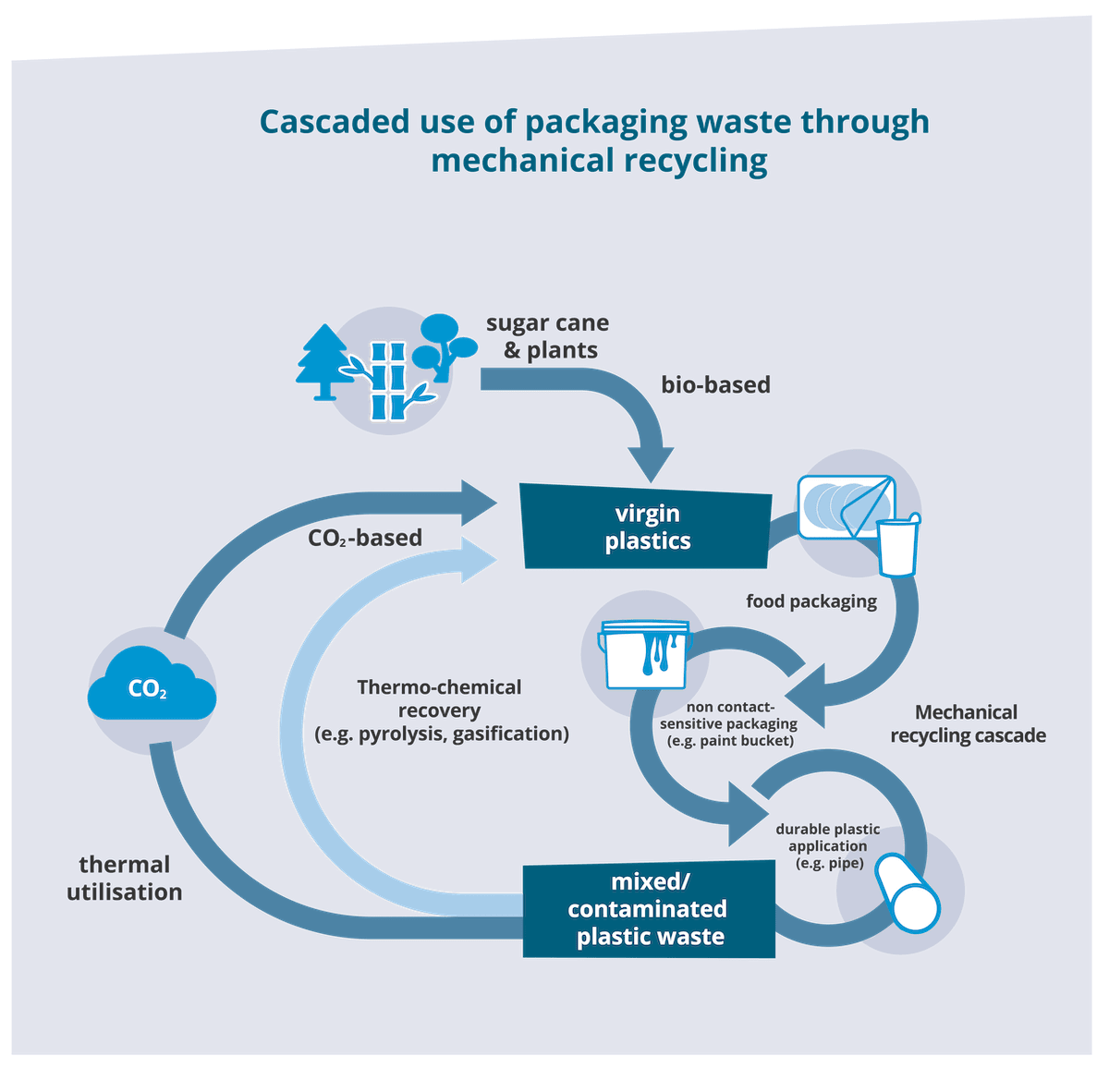

In the future, chemical recycling can close a gap in the circular economy of plastics by processing waste that cannot be mechanically recycled into secondary raw materials for the production of new plastics. This opens up new fields of application for recyclates, especially in the area of food packaging. Together with the use of biomass and CO2 as well as the conversion to renewable energies, it forms a key technology to be able to completely dispense with fossil raw materials in the plastics sector by 2050 and to achieve climate neutrality. However, chemical recycling processes do not offer an alternative to energy- and cost-efficient mechanical recycling.

No. The purchase of credits is merely a means of being able to comply with the legal requirements of the recycled content quotas in the event of a shortage, to cushion economic and ecological risks and to increase the overall economic efficiency of the transformation. In order to avoid misleading the consumer, it should be ruled out that the buyer of credits advertises the compensated recycled content as recycled material contained in the product.

Trading in credits must be monitored just as strictly as trading in post-consumer recyclates itself. However, the monitoring effort in both cases does not differ significantly. Since the recycled content in packaging cannot be analytically determined via laboratory methods, auditing methods such as purchase receipts etc. are required anyway to provide secure evidence of the material flows. A complete traceability of recycling back to the waste source is essential to ensure that the recyclate was produced from waste after use and that recycled quantities were not taken into account more than once. In the value chain, the necessary data is already available in audited form at various points (e.g. declarations of completeness, EUCERTPLAST certificates for recycling companies). In the case of credit trading, this verification also extends to the production of the manufacturer who sells the credits. The Commission has announced that it will lay down the rules for the calculation and verification of the recycled content in an implementing act pursuant to Article 7(7) PPWR.

The credit system secures the demand for high-quality plastic recyclates in the overall market and thus establishes planning security for investments in separate waste collection, sorting and recycling. This demand is independent of price fluctuations in the primary raw materials market – a major barrier to investment in the Circular Economy is thus overcome.

With the gradual increase in PCR quotas, also in other sectors, the use of recyclates is also gradually advancing in increasingly demanding applications, right up to food contact. The EU Packaging Regulation, for example, envisages a significant increase in the use of PCR by 2040 (to 50 to 65 per cent). The Commission is also planning a PCR quota of 25 per cent in automotive parts. Other sectors will follow. Credits will thus become increasingly scarce and expensive on the market, because they will only be granted if the use of recycled material exceeds the legal requirements. Through this mechanism, the use of recyclates in contact-sensitive packaging is becoming more and more financially incentivised and is ultimately unavoidable.

If the purchase of credits does not entitle a company to advertise a recyclate content in its own products, a further financial incentive is given to use the recyclate in its own products in order to be able to advertise it on the market.